what is an example of an ad valorem tax

The most common ad valorem. Ad Valorem Tax.

What Is Ad Valorem Tax A Guide For Real Estate Investors Fortunebuilders

The tax is usually expressed as a percentage.

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

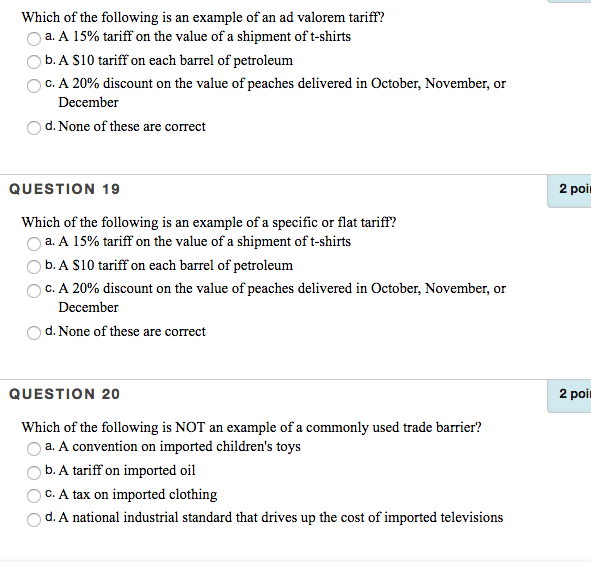

. Ad valorem sentence example. Which of the following is an example of an ad valorem tax. One prime example is the Value Added Tax VAT which varies in percentage depending on the assessed value of the.

For example if the total of state county and local taxes was 8 percent and the total taxable cost of your car was. 3 Examples of Ad Valorem Taxes. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

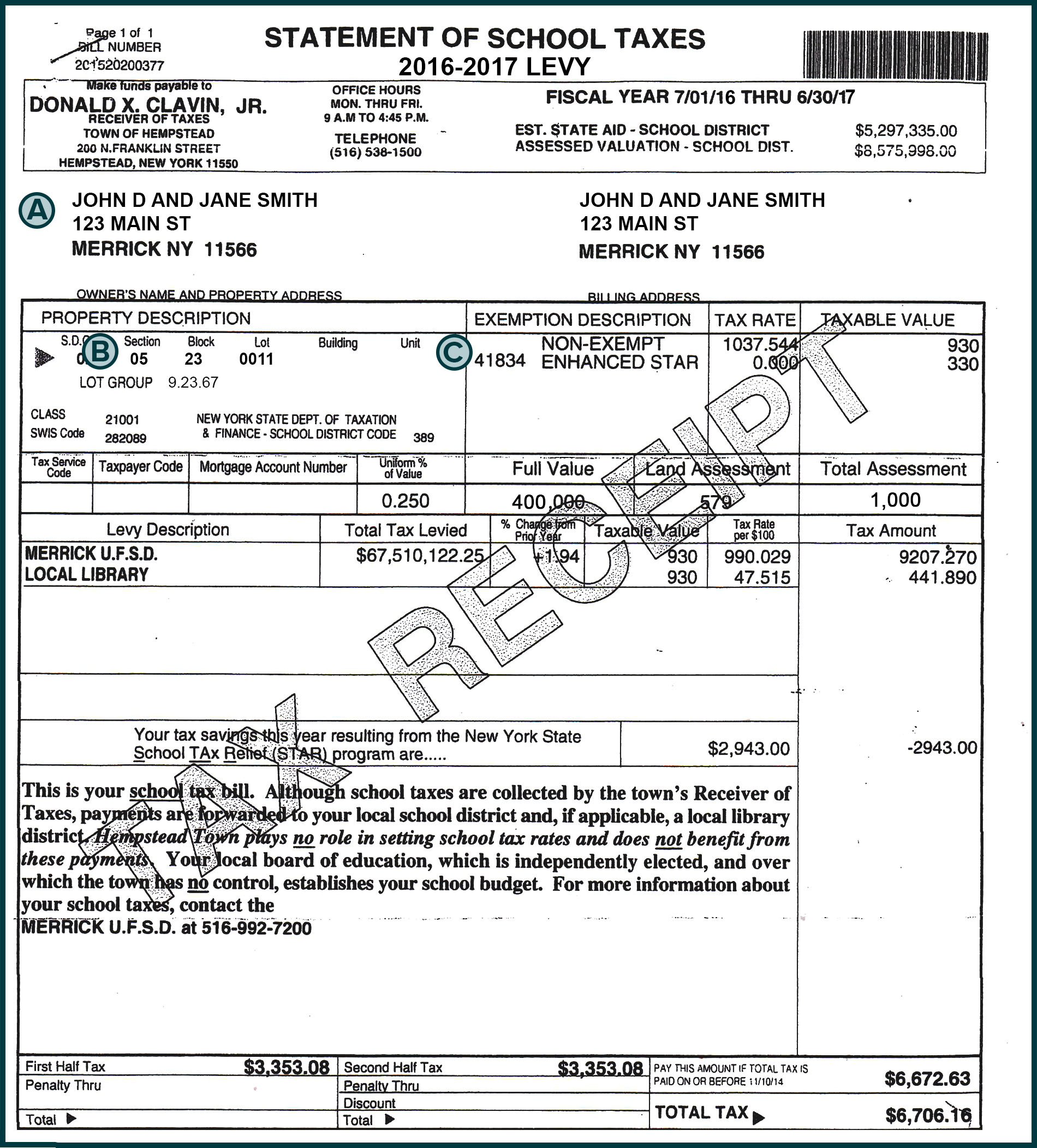

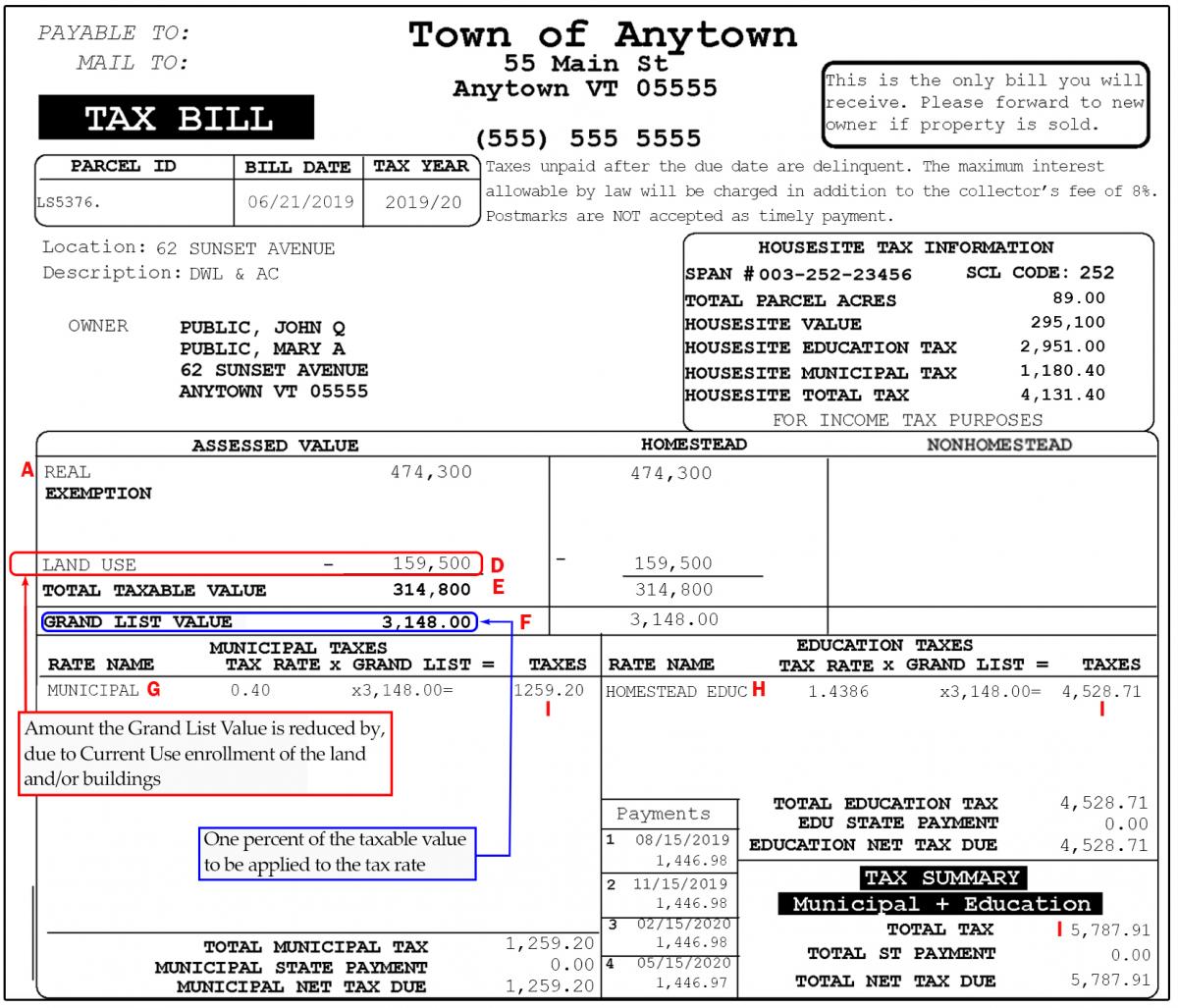

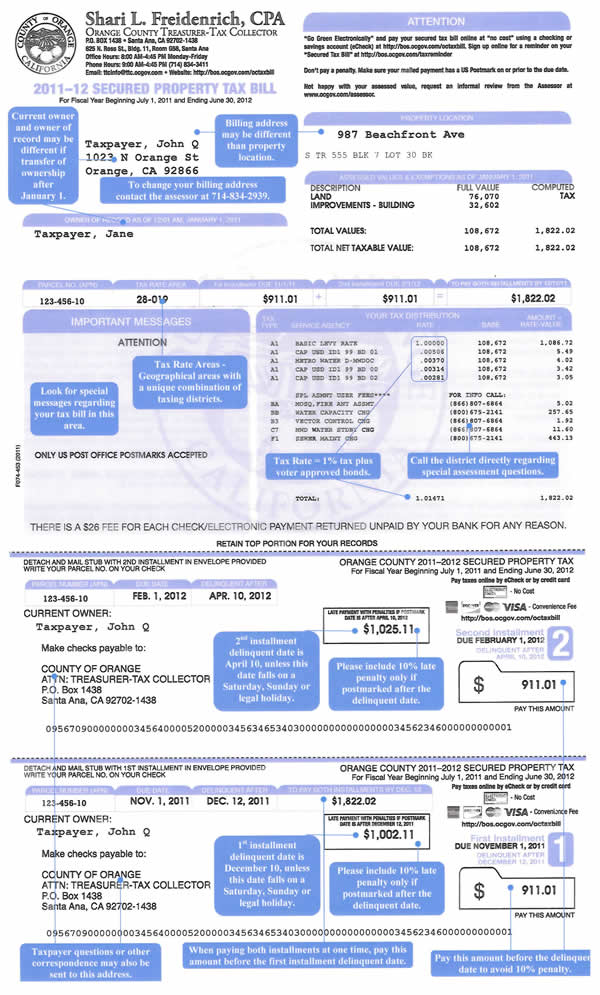

Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the. Local government entities may levy an ad valorem tax on real estate and other major personal property. Ad valorem taxes are taxes determined by the assessed value of an item.

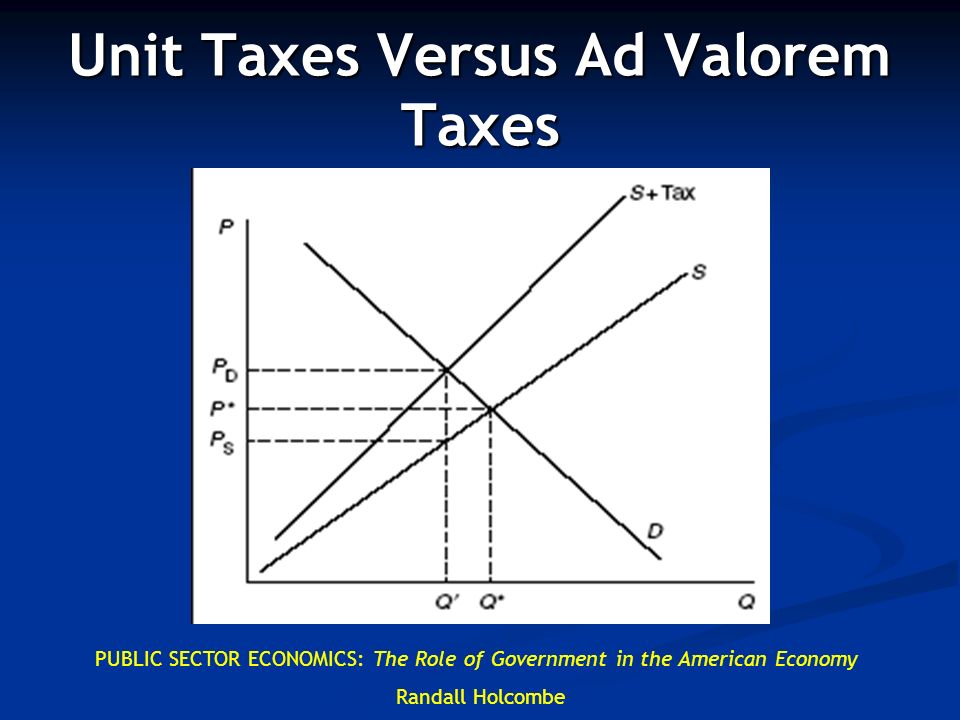

An ad valorem tax is based on the value of an item at the time of the transaction or assessment. The most common ad valorem tax examples include property taxes on real. An ad valorem tax allows to easily adjusting the amount to be paid in any given occasion.

What is an example of an ad valorem tax is. About 4000 were thus annually imported and an ad valorem duty was levied by the. What is an example of an ad valorem tax is.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad valorem tax is a common form of taxation on real property such as.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. An example of an Ad Valorem Tax. The most common ad valorem.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. Imports are charged 8 exports 1 ad valorem duty. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

The name of the tax stems from a Latin phrase and means according to value. It is generally calculated as a percentage of. What is ad valorem tax example.

Examples of values that could be used to determine an. An ad valorem tax is a form of taxation based on the value of a transaction or a property either real estate or personal property. What is an example of an ad valorem tax is.

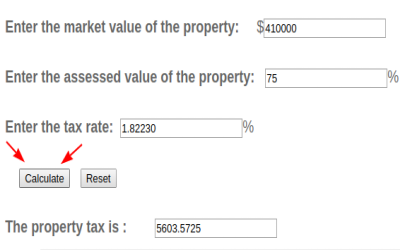

The most common ad valorem tax examples include property taxes on real. Multiply the sales tax rate by your taxable purchase price. In a nutshell ad valorem tax is a type of tax that is charged on property according to the propertys value.

The most common ad. For example if this tax is applied to the value of a property every year the tax burden will increase. Homeowners property taxes are.

An ad valorem tax imposes a tax on a good or asset depending on its value. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property. Ad valorem taxes are taxes that are levied as a percentage of the assessed value of a piece of property.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem tax examples include property. For example in the UK VAT is charged at 20 on.

Solved Which Of The Following Is An Example Of An Ad Valorem Chegg Com

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

Solved An Example Of Ad Valorem Taxation Is 0 A The Chegg Com

What Is Ad Valorem Understand Ad Valorem Meaning Examples And Importance

Current Use And Your Property Tax Bill Department Of Taxes

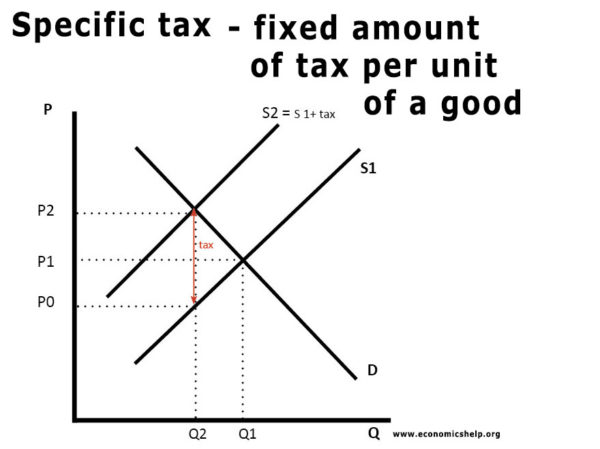

Excise Taxes Unit Taxes Ad Valorem Taxes Ppt Video Online Download

1 8 Ie Pk Specific Tax And Ad Valorem Tax Explained With Examples Youtube

1099 Misc For Royality On Oilandgas

Ad Valorem Tax Explained Budgetable

Tax Rates Gordon County Government

Real Estate Property Tax Constitutional Tax Collector

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition And How It S Determined

Secured Tax Bill Example Oc Treasurer Tax Collector

Specific Taxes Ad Valorem Taxes Direct And Indirect Taxes Youtube